The amount of money you borrow from a venture capitalist depends on how much business financing you need. How Much Money Do You Need for Venture Capital? The National Venture Capital Association has a useful list of resources on the initiative. The market hasn’t quite caught up to the need yet, so it’s still much more difficult for a small business to get venture capital, but that doesn’t mean it’s not possible.įor example, the State Small Business Credit Initiative (SSBCI) is open to small and underserved businesses and allows for debt or equity investments. Remaining an LLC might make it more difficult to secure venture capital, however.Īccording to Crunchbase, because of the rush to digital after the pandemic, small businesses have a much greater opportunity for high-speed growth and entrepreneurship. says it was able to remain an LLC while getting venture capital investments, even though there was pressure to become a corporation. Also, LLCs can avoid UBTI by setting up what’s called an intermediate blocker company that acts as a middleman. If they do go that route, they can convert to a corporation at any time if they need to, so it’s not necessary to start as a corporation. According to Inc., very few startups end up going public. recommends remaining an LLC to avoid corporate tax once the business is sold, which can be up to 30%. Businesses are encouraged by investors to turn into corporations for two reasons: If you plan to sell shares, your business must have a corporate structure and LLCs can generate income called unrelated business taxable income (UBTI) that can become problematic for investors attempting to keep a tax-exempt status. Most venture-funded businesses are C-corporations rather than LLCs - but LLCs can get venture capital funding.

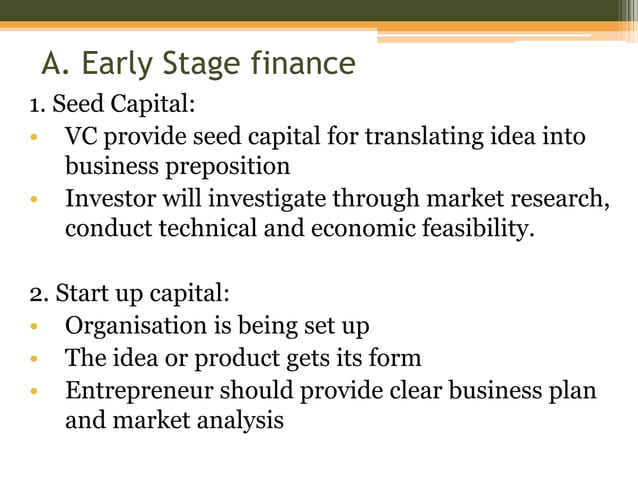

We walk through the steps to obtaining VC funding a little later in the article. Then it goes into first-stage, second-stage, and mezzanine (or bridge) financing for growing businesses. Seed capital is for business ideas, while startup financing funds new businesses with one full-time management member working on it.

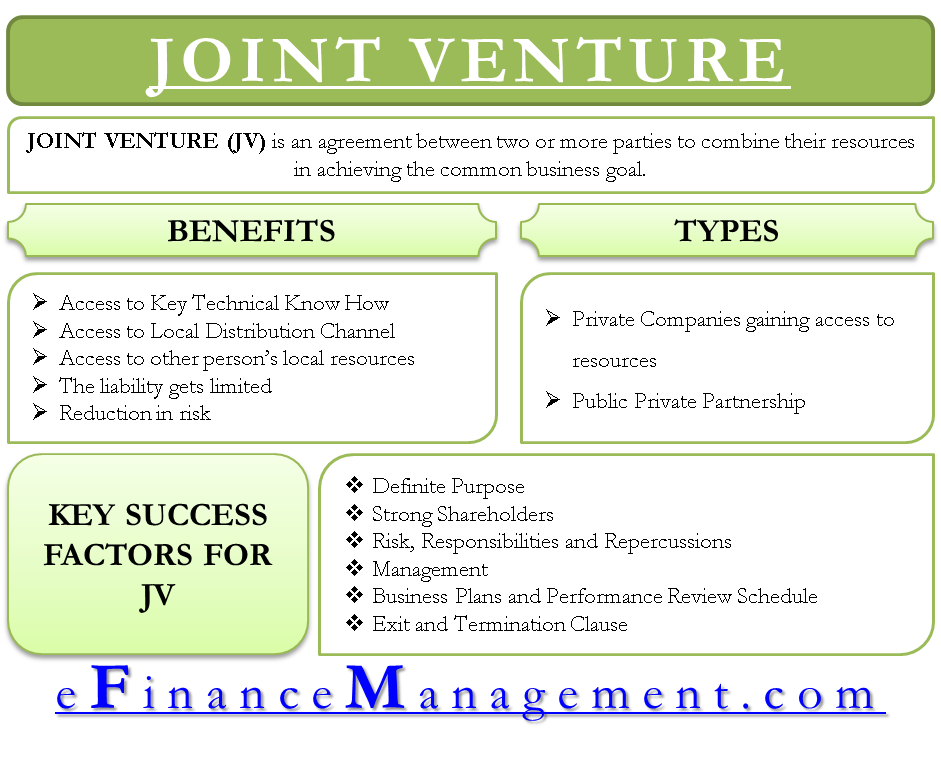

The investment can come from an individual or angel investor, a venture capital firm (where lots of investors pool their money, called private equity), or a financial institution.Īlthough VC firms typically look for early-stage or new businesses, some companies seek out venture capital in later stages. According to the National Bureau of Economic Research, the most likely return is 25%, but can be significantly higher.

The important thing to note is that venture capitalists are looking for a high rate of return.

0 kommentar(er)

0 kommentar(er)